OFC/NFOEC 2013 to highlight a period of change

Friday, March 15, 2013 at 6:56AM

Friday, March 15, 2013 at 6:56AM Next week's OFC/NFOEC conference and exhibition, to be held in Anaheim, California, provides an opportunity to assess developments in the network and the data centre and get an update on emerging, potentially disruptive technologies.

Source: Gazettabyte

Source: Gazettabyte

Several networking developments suggest a period of change and opportunity for the industry. Yet the impact on optical component players will be subtle, with players being spared the full effects of any disruption. Meanwhile, industry players must contend with the ongoing challenges of fierce competition and price erosion while also funding much needed innovation.

The last year has seen the rise of software-defined networking (SDN), the operator-backed Network Functions Virtualization (NFV) initiative and growing interest in silicon photonics.

SDN has already being deployed in the data centre. Large data centre adopters are using an open standard implementation of SDN, OpenFlow, to control and tackle changing traffic flow requirements and workloads.

Telcos are also interested in SDN. They view the emerging technology as providing a more fundamental way to optimise their all-IP networks in terms of processing, storage and transport.

Carrier requirements are broader than those of data centre operators; unsurprising given their more complex networks. It is also unclear how open and interoperable SDN will be, given that established vendors are less keen to enable their switches and IP routers to be externally controlled. But the consensus is that the telcos and large content service providers backing SDN are too important to ignore. If traditional switching and routers hamper the initiative with proprietary add-ons, newer players will willing fulfill requirements.

Optical component players must assess how SDN will impact the optical layer and perhaps even components, a topic the OIF is already investigating, while keeping an eye on whether SDN causes market share shifts among switch and router vendors.

The ETSI Network Functions Virtualization (NFV) is an operator-backed initiative that has received far less media attention than SDN. With NFV, telcos want to embrace IT server technology to replace the many specialist hardware boxes that take up valuable space, consume power, add to their already complex operations support systems (OSS) while requiring specialist staff. By moving functions such as firewalls, gateways, and deep packet inspection onto cheap servers scaled using Ethernet switches, operators want lower cost systems running virtualised implementations of these functions.

The two-year NFV initiative could prove disruptive for many specialist vendors albeit ones whose equipment operate at higher layers of the network, removed from the optical layer. But the takeaway for optical component players is how pervasive virtualisation technology is becoming and the continual rise of the data centre.

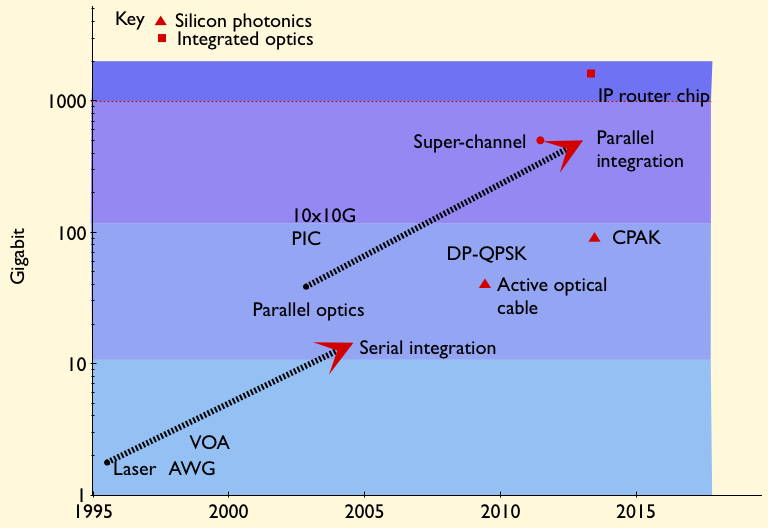

Silicon photonics is one technology set to impact the data centre. The technology is already being used in active optical cables and optical engines to connect data centre equipment, and soon will appear in optical transceivers such as Cisco Systems' own 100Gbps CPAK module.

Silicon photonics promises to enable designs that disrupt existing equipment. Start-up Compass-EOS has announced a compact IP core router that is already running live operator traffic. The router makes use of a scalable chip coupled to huge-bandwidth optical interfaces based on 168, 8 Gigabit-per-second (Gbps) vertical-cavity surface-emitting lasers (VCSELs) and photodetectors. The Terabit-plus bandwidth enables all the router chips to be connected in a mesh, doing away with the need for the router's midplane and switching fabric.

The integrated silicon-optics design is not strictly silicon photonics - silicon used as a medium for light - but it shows how optics is starting to be used for short distance links to enable disruptive system designs.

Some financial analysts are beating the drum of silicon photonics. But integrated designs using VCSELs, traditional photonic integration and silicon photonics will all co-exist for years to come and even though silicon photonics is expected to make a big impact in the data centre, the Compass-EOS router highlights how disruptive designs can occur in telecoms.

Market status

The optical component industry continues to contend with more immediate challenges after experiencing sharp price declines in 2012.

The good news is that market research companies do not expect a repeat of the harsh price declines anytime soon. They also forecast better market prospects: The Dell'Oro Group expects optical transport to grow through 2017 at a compound annual growth rate (CAGR) of 10 percent, while LightCounting expects the optical transceiver market to grow 50 percent, to US $5.1bn in 2017. Meanwhile Ovum estimates the optical component market will grow by a mid-single-digit percent in 2013 after a contraction in 2012.

In the last year it has become clear how high-speed optical transport will evolve. The equipment makers' latest generation coherent ASICs use advanced modulation techniques, add flexibility by trading transport speed with reach, and use super-channels to support 400 Gigabit and 1 Terabit transmissions. Vendors are also looking longer term to techniques such as spatial-division multiplexing as fibre spectrum usage starts to approach the theoretical limit.

Yet the emphasis on 400 Gigabit and even 1 Terabit is somewhat surprising given how 100 Gigabit deployment is still in its infancy. And if the high-speed optical transmission roadmap is now clear, issues remain.

OFC/NFOEC 2013 will highlight the progress in 100 Gigabit transponder form factors that follow the 5x7-inch MSA, 100 Gigabit pluggable coherent modules, and the uptake of 100 Gigabit direct-detection modules for shorter reach links - tens or hundreds of kilometers - to connect data centres, for example.

There is also an industry consensus regarding wavelength-selective switches (WSSes) - the key building block of ROADMs - with the industry choosing a route-and-select architecture, although that was already the case a year ago.

There will also be announcements at OFC/NFOEC regarding client-side 40 and 100 Gigabit Ethernet developments based on the CFP2 and CFP4 that promise denser interfaces and Terabit capacity blades. Oclaro has already detailed its 100GBASE-LR4 10km CFP2 while Avago Technologies has announced its 100GBASE-SR10 parallel fibre CFP2 with a reach of 150m over OM4 fibre.

The CFP2 and QSFP+ make use of integrated photonic designs. Progress in optical integration, as always, is one topic to watch for at the show.

PON and WDM-PON remain areas of interest. Not so much developments in state-of-the-art transceivers such as for 10 Gigabit EPON and XG-PON1, though clearly of interest, but rather enhancements of existing technologies that benefit the economics of deployment.

The article is based on a news analysis published by the organisers before this year's OFC/NFOEC event.

Reader Comments