The industry initiative to open up the radio access network, known as open RAN, is changing how the mobile network is architected and is proving its detractors wrong.

So says a recent open RAN study by market research company, LightCounting.

Stéphane Téral

Stéphane Téral

"The virtual RAN and open RAN sceptics are wrong," says Stéphane Téral, chief analyst at LightCounting.

Japan's mobile operators, Rakuten Mobile and NTT Docomo, lead the world with large-scale open RAN deployments.

Meanwhile, many leading communications service providers (CSPs) continue to trial the technology with substantial deployments planned around 2024-25.

Japan's fourth and newest mobile network operator, Rakuten Mobile, deployed 40,000 open RAN sites with 200,000 radio units by the start of 2022.

Meanwhile, NTT Docomo, Japan's largest mobile operator, deployed 10,000 sites in 2021 and will deploy another 10,000 this year.

NTT Docomo has shown that open RAN also benefits incumbent operators, not just new mobile entrants like Rakuten Mobile and Dish Networks in the US that can embrace the latest technologies as they roll out their networks.

Virtual RAN and open virtual RAN

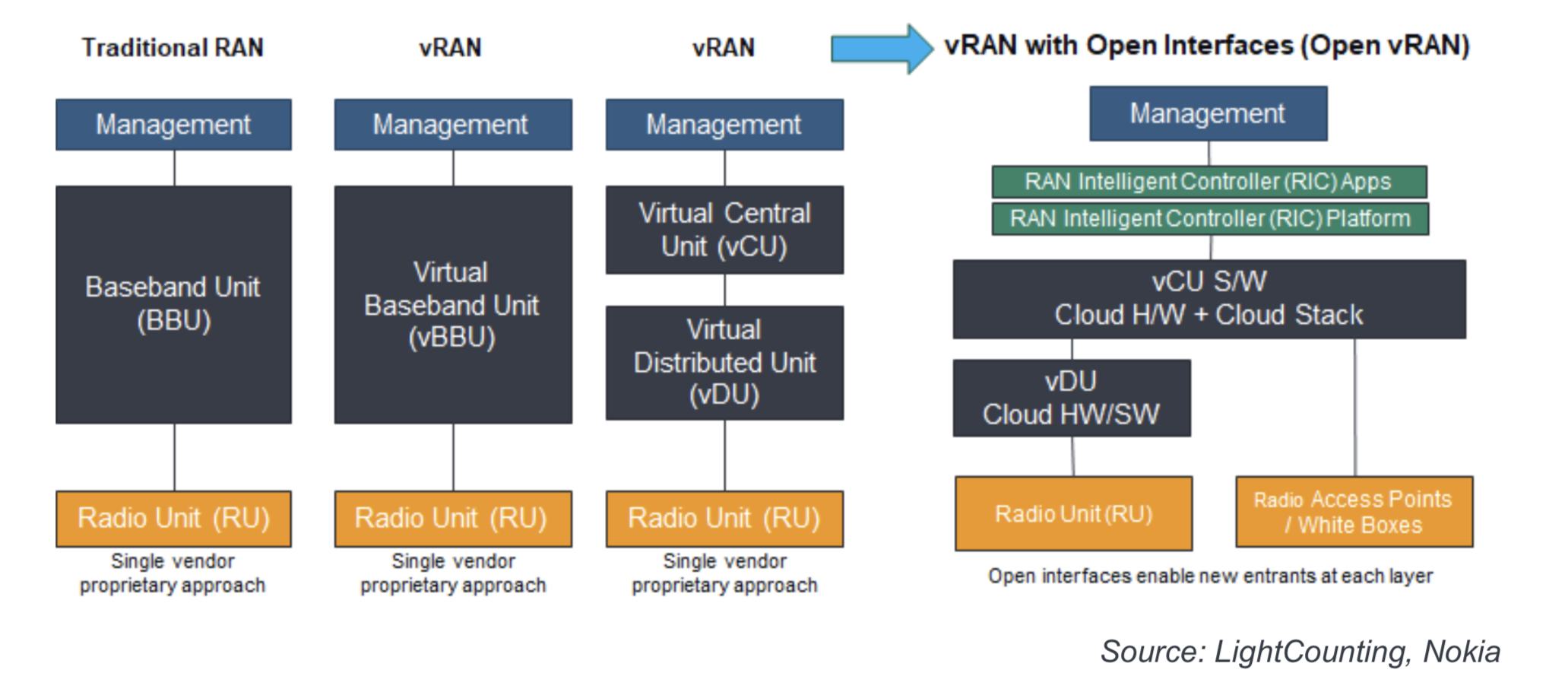

Traditional RANs use a radio unit and a baseband unit from the same equipment supplier. Such RAN systems use proprietary interfaces between the units, with the vendor also providing a custom software stack, including management software.

The vendor may also offer a virtualised system that implements some or all of the baseband unit's functions as software running on server CPUs.

A further step is disaggregating the baseband unit's functions into a distributed unit (DU) and a centralised unit (CU). Placing the two units at different locations is then possible.

A disaggregated design may also be from a single vendor but the goal of open RAN is to enable CSPs to mix and match RAN components from different suppliers. Accordingly, the virtual RAN using open interfaces, as specified by the O-RAN Alliance, is an open virtual RAN system.

The diagram shows the different architectures leading to the disaggregated, virtualised RAN (vRAN) architecture.

Open virtual RAN comprises radio units, the DU and CU functions that can be implemented in the cloud, and the RAN Intelligent Controller (RIC), the brain of the RAN, which runs applications.

Several radio units may be connected to a virtual DU. The radio unit and virtual DU may be co-located or separate, linked using front-haul technology. Equally, the CU can host several virtual DUs depending on the networking requirements, connected with a mid-haul link.

Rakuten Mobile has deployed the world’s largest open virtual RAN architecture, while NTT Docomo has the world’s largest brownfield open RAN deployment.

NTT Docomo's deployment is not virtualised and is not running RAN functions in software.

"NTT Docomo's baseband unit is not disaggregated," says Téral. "It's a traditional RAN with a front-haul using the O-RAN Alliance specification for 5G."

NTT Docomo is working to virtualise the baseband units and the work is likely to be completed in 2023.

Opening the RAN

NTT Docomo and the MGMN Alliance were working on interoperability between RAN vendors 15 years ago, says Téral. The Japanese mobile operator wanted to avoid vendor lock-in and increase its options.

"NTT Docomo was the only one doing it and, as such, could not enjoy economies of scale because there was no global implementation," says Téral.

Wider industry backing arrived in 2016 with the formation of the Telecom Infra Project (TIP) backed by Meta (Facebook) and several CSPs to design network architectures that promoted interoperability using open equipment.

The O-RAN Alliance formed in 2018 was another critical development. With over 300 members, the O-RAN Alliance has ten working groups addressing such topics as defining the interfaces between RAN functions to standardise the open RAN architecture.

The O-RAN Alliance realised it needed to create more flexibility to enable boxes to be interchanged, says Téral, and started in the RAN to allow any radio unit to work with any virtual DU.

Geopolitics is the third element to kickstart open RAN. Removing Chinese equipment vendors Huawei and ZTE from key markets brought Open RAN to the forefront as a way to expand suppliers.

Indeed, Rakuten Mobile was about to select Huawei for its network, but it decided in 2018 to adopt open RAN instead because of geopolitics.

"Geopolitics added a new layer and, to some extent, accelerated the development of open RAN," he says. "But it does not mean it has accelerated market uptake."

That's because the first wave of 5G deployments by the early adopter CSPs seeking a first-mover advantage is ending. Indeed, the uptake in 5G's first three years has eclipsed the equivalent rollout of 4G, says LightCounting.

To date, over 200 of 800 mobile operators worldwide have deployed 5G.

Early 5G adopters have gone with traditional RAN suppliers like Ericsson, Nokia, Samsung, NEC and Fujitsu. And with open RAN only now hitting its stride, it has largely missed the initial 5G wave.

Open RAN's next wave

For the next two years, then, the dominant open RAN deployments will continue to be those of Rakuten Mobile and NTT Docomo, to which can be added the network launches from Dish Networks in the US, and 1&1 Drillisch of Germany, which is outsourcing its buildout to Rakuten Symphony.

Rakuten Mobile's vendor offshoot, Rakuten Symphony, set up to commercialise Rakuten's open RAN experiences, is also working with Dish Networks on its deployment.

Rakuten Mobile hosts its own 5G network, including open RAN in its data centres. Dish is working with cloud player Amazon Web Services to host its 5G network. Dish's network is still in its early stages, but the mobile operator can host its network in Amazon's cloud because it uses a cloud-native implementation that includes Open RAN.

The next market wave for Open RAN will start in 2024-25 when the leading CSPs begin to turn off their 3G and start deploying Open RAN for 5G.

It will also be helped by the second wave of 5G rollouts those 600 operators with LTE networks. However, this second 5G cycle may not be as large as the first cycle, says Téral, and there will be a lag between the two cycles that will not be helped if there is a coming economic recession.

Specific leading CSPs that were early cheerleaders for open RAN has since dampened their deployment plans, says Téral. For example, Telefónica and Vodafone first spoke in 2019 of 1,000s of site deployments but have scaled back their deployment plans.

The leading CSPs explain their reluctance to deploy open RAN due to its many challenges. One is interoperability issues; despite the development of open interfaces, getting the different vendors' components to work together is still a challenge.

Another issue is integration. Disaggregating the various RAN components means someone must stitch them together. Certain CSPs do this themselves, but there is a need for system integrators, and this is a challenge.

Téral believes that while these are valid concerns, Rakuten and NTT Docomo have already overcome such complications; open RAN is now deployed at scale.

These CSPs are also reluctant to end their relationships with established suppliers.

"The service providers' teams have built relationships and are used to dealing with the same vendors for so long," says Téral. "It's very complicated for them to build new relationships with somebody else."

More RAN player entrants

Rakuten Symphony has assembled a team with tremendous open RAN experience. AT&T is one prominant CSP that has selected Rakuten Symphony to help it with network planning and speed up deployments.

NTT Docomo working with four vendors, has got their radio units and baseband units to work with each other. In addition, NTT Docomo is also promoting its platform dubbed OREC (5G Open RAN Ecosystem) to other interested parties.

NEC and Fujitsu, selected by NTT Docomo, have also gained valuable open RAN experience. Fujitsu is a system integrator with Dish while NEC is involved in many open RAN networks in Europe, starting with Telefónica.

There is also a commercial advantage for these systems vendors since Rakuten Mobile and NTT Docomo are the leading operators, along with DISH and 1&1, deploying open RAN for the next two years.

That said, the radio unit business continues to look up. "There is no cycle [with radio units]; you still have to add radio units at some point in particular parts of the network," says Téral.

But for open RAN, those vendors not used by NTT Docomo and Rakuten Mobile must wait for the next deployment wave. Vendor consolidation is thus inevitable; Parallel Wireless being the first shoe to drop with its recently announced wide-scale layoffs.

So while open RAN has expanded the number of vendor suppliers, further acquisitions should be expected, as well as companies folding that will not survive until the next deployment wave, says Téral.

And soon at the chip level too

There is also a supply issue with open RAN silicon.

With its CPUs and FlexRAN software, Intel dominates the open RAN market. However, the CSPs acknowledge there is no point in expanding RAN suppliers if there is a vendor lock-in at the chip level, one layer below.

Téral says several chip makers are working with system vendors to enter the market with alternative solutions. These include ARM-based architectures, AMD-Xilinx, Qualcomm, Marvell's Octeon family and Nvidia's BlueField-3 data processing unit.

The CSPs are also getting involved in promoting more chip choices. For example, Vodafone has set up a 50-strong research team at its new R&D centre in Malaga, Spain, to work with chip and software companies to develop the architecture of choice for Open RAN to expand the chip options.

Outlook

LightCounting forecasts that the open vRAN market will account for 13 per cent of the total global RAN sales in 2027, up from 4 per cent in 2022.

A key growth driver will be the global switch to open virtual RAN in 2024-25, driven by the large Tier 1 CSPs worldwide.

"Between 2025 and 2030, you will see a mix of open RAN, and where it makes sense in parts of the network, traditional RAN deployments too," says Téral.