Part 1: Yole market analysis

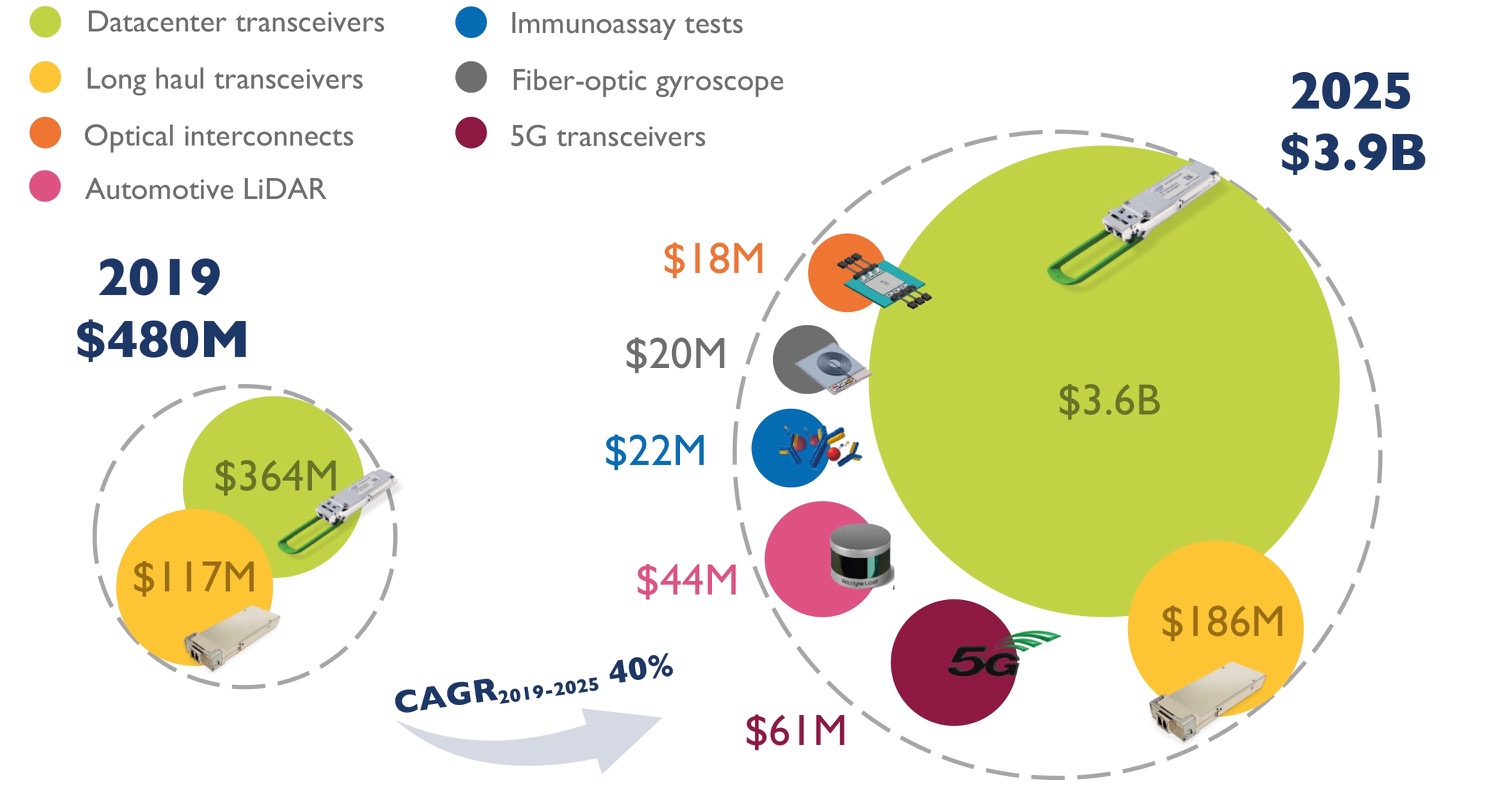

The market for silicon photonics is set to grow eightfold by 2025.

So claims market research firm, Yole Développement, in its latest report on silicon photonics, a technology that enables optical components to be made on a silicon substrate.

Silicon photonics is also being used in new markets although optical transceivers will still account for the bulk of the revenues in 2025.

Market forecast

“We are entering a phase where we are beyond the tipping point [for silicon photonics],” says Eric Mounier, fellow analyst at Yole. “There is no doubt silicon photonics will grow and will be used beyond the data centre.”

Yole sized the 2019 global silicon photonics market at US $480 million, dominated by sales of optical transceivers for the data centre. In 2025 the forecast is for a $3.9 billion market, with data centre transceivers accounting for over 90 per cent of the market.

Eric MounierRevenues from new markets such as 5G optical transceivers, automotive, co-packaged optics, fibre-optic gyroscopes, and biochemical sensors will generate $165 million revenues in 2025.

Eric MounierRevenues from new markets such as 5G optical transceivers, automotive, co-packaged optics, fibre-optic gyroscopes, and biochemical sensors will generate $165 million revenues in 2025.

The Yole report also highlights a maturing supply chain, advances in co-packaged optics, and more silicon photonics start-up announcements in the last year.

“It seems the big data centre operators, telecom players and sensor companies are convinced silicon photonics is a key technology for integration, lower cost and smaller components for interconnect and sensing applications,” says Mounier.

Optical transceivers

Data centre optical transceivers account for the bulk of silicon photonics’ market value and unit volumes.

Three-quarters of revenues in 2019 were for data centre transceivers for reaches ranging from several hundred meters to 2km and 10km. This market for silicon photonics is dominated by two players: Intel and Cisco with its Luxtera acquisition.

“For 100-gigabit transceivers, silicon photonics is probably the most used technology compared to legacy optics,” says Mounier.

The remaining 2019 revenues were from long-haul coherent transceiver sales, a market dominated by Acacia that is being acquired by Cisco.

Other companies involved in the transceiver supply chain include Innolight, Juniper Networks, and Alibaba with its work with Elenion Technologies (Elenion was recently acquired by Nokia). HP is working with several firms to develop its silicon photonics supply chain, from device design to final products.

The rollout of 5G is generating a need for 10-gigabit and 25-gigabit transceivers for distances up to 100m, linking remote radio heads and the baseband unit, part of the 5G radio access network.

Yole forecasts a $61 million 5G transceiver market in 2025.

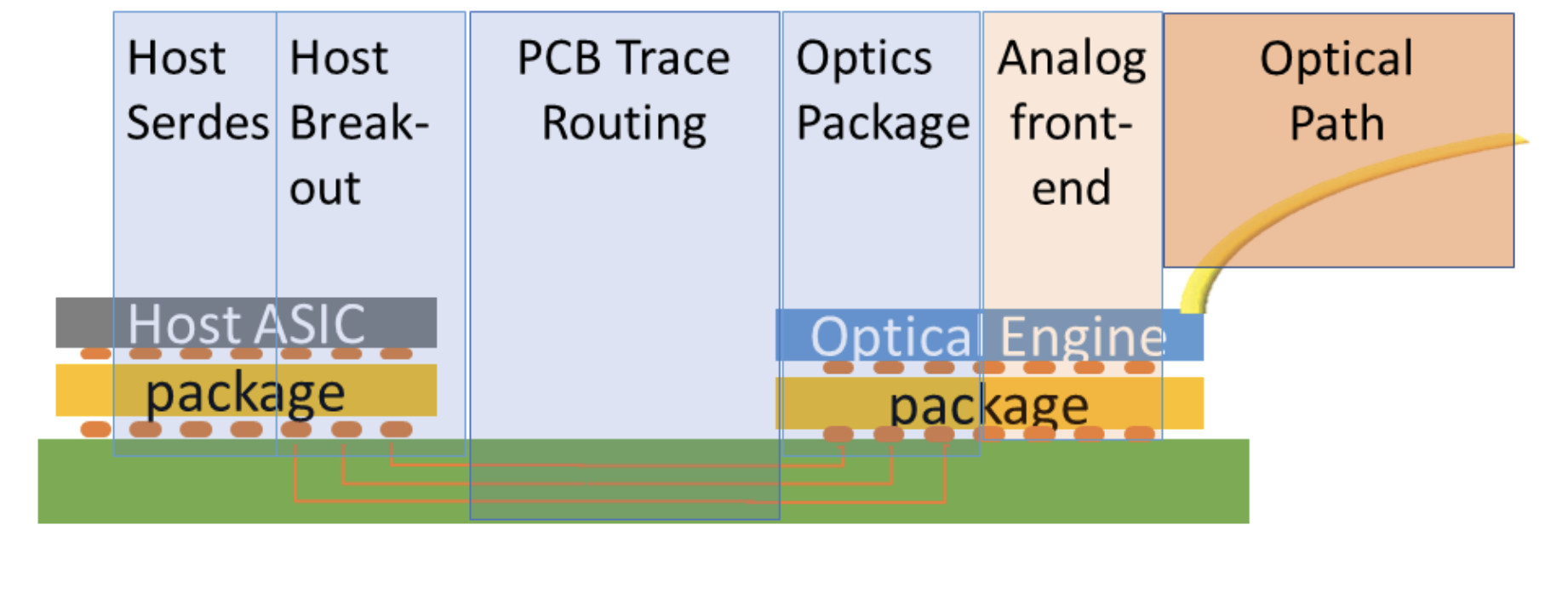

Co-packaged optics

The packaging of optical input-output with a digital chip, known as co-packaged optics, has made notable progress in the last year.

“We are pretty convinced that co-packaged optics is the next big application for silicon photonics,” says Mounier.

Intel has demonstrated its optics packaged with the Tofino 2 Ethernet switch chip it gained with the Barefoot Networks acquisition. “Talking to Intel, I believe in two to three years from now, there will be the first product,” he says.

Other firms pursuing co-packaged optics include Ranovus, Rockley Photonics, Ayar Labs and Sicoya.

The doubling in Ethernet switch-chip capacity every two years is a key driver for co-packaged optics. Switch chips with 25.6-terabit capacity exist and 51.2-terabit switches will be shipping by 2025.

There will also be eight-hundred-gigabit pluggable transceivers in 2025 but Yole says co-packaged optics offers a systems approach to increasing channel counts to keep pace with growing switch capacities.

Foundries and design houses

More than 10 foundries exist worldwide offering silicon photonics services.

“Foundries are interested in silicon photonics because they see a future opportunity for them to fill their fabs,” says Mounier.

Yole cites how GlobalFoundries is working with Ayar Labs, HP with TSMC, Sicoya with IHP Microelectronics, and Rockley Photonics with VTT Memsfab. TSMC also works with Cisco through its Luxtera acquisition.

Swedish MEMS foundry, Silex Microsystems, is developing a portfolio of silicon photonics technology. “They are working with many players developing telecom photonic platforms,” says Mounier.

There are also several design houses offering photonic design services to companies that want to bring products to market. Examples include VLC Photonics, Luceda, Photon Design and Effect Photonics.

Optical design requires know-how that not all firms have, says Mounier. Such silicon photonics design services recall the ASIC design houses that provided a similar service to the electronics industry some two decades ago.

Sensors

Lidar used for autonomous cars and biochemical chips are two emerging sensor markets embracing silicon photonics. Lidar (light detection and ranging) uses light to sense a vehicle’s surroundings.

“Lidar systems are bulky and expensive and a car needs several, at the front, rear and sides,” says Mounier. “Silicon photonics is an emerging platform for the integration of such devices.”

Two Lidar approaches are using silicon photonics: frequency modulation continuous wave (FMCW) Lidar, also known as coherent Lidar, and an optical phased array.

For coherent Lidar, the transmitted frequency of the laser - represented by the local oscillator - and the reflected signal are mixed coherently. This enables phase and amplitude information to be recovered to determine an object’s position and velocity.

SiLC Technologies has developed a FMCW Lidar chip. Working with Varroc Lighting Systems, the two firms have demonstrated Lidar integrated into a car headlamp.

The second approach - an optical phased array - steers the beam of light without using any moving parts.

Lidar is complex and can be implemented using other technologies besides silicon photonics, says Mounier: “Silicon photonics for Lidar has several advantages but it is not clear why the technology will be used in the car or for robotic vehicles.”

In turn, the emerging economic crisis worldwide will likely delay the development of the autonomous car, he says.

Other sensor developments include silicon photonics-based biosensors from Genalyte that use lasers, micro-ring resonators and detectors to produce fast biological test results. The US company has raised over $90 million in three rounds of funding.

French firm Aryballe produces a tiny photonic IC that acts as an electronic nose (digital olfaction). “Using silicon photonics, you can integrate everything on a chip,” says Mounier. “It needs less packaging and assembly and you get a tiny chip at the end.”

COVID-19

Silicon photonics shipments have been delayed in the first half of 2020 due to the COVID-19 pandemic, says Yole. But the market for silicon photonics will still grow this year albeit not at the originally forecasted 10 per cent.

“Everyone is working from home and there is a need for more networking bandwidth,” says Mounier. There will continued demand for transceivers for the data centre and telecom services.

“Market growth will be positive for telecoms, and markets such as defence and medical will not be much impacted,” he says.