In a talk at the FutureNet World conference, held in London on May 3-4, Neil McRae explains why he is upbeat about the telecoms industry's prospects

Neil McRae at Futurenet World, London earlier this month.

Neil McRae at Futurenet World, London earlier this month.

Neil McRae is tasked with giving the final talk of the two-day FutureNet World conference.

"Yeah, I'm on the graveyard shift," he quips.

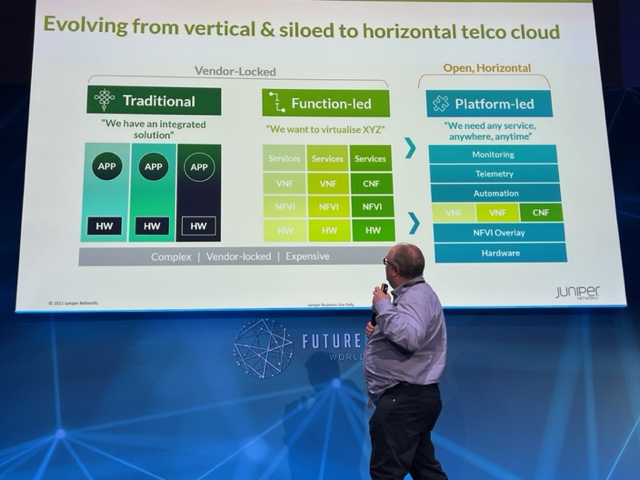

McRae, the former chief network architect at BT, is now chief network strategist at Juniper Network.

The talk’s title is "What's Next", McRae's take on the telecom industry and how it can grow.

McRae starts with how, as a 15-year-old, he had attended an Apple Macintosh computer event at a Novotel Hotel in Hammersmith, London, possibly even this one hosting this conference.

An Apple representative had asked for his feedback as a Macintosh programmer. McRae then listed all the shortfalls programming the PC. Later, he learnt that he had been talking to Steve Jobs.

Perhaps this explains his continual focus on customers and meeting their needs.

What customers care about, says McRae, is 'new stuff' that makes a difference in their lives. "Quite often in telecoms, we accidentally change the world without even thinking about it," he says

McRae cites as an example using FaceTime to watch a newborn grandchild halfway across the world.

"We do it all the time; it is a phenomenal thing about our industry," says McRae.

The Unvarnished Truth

McRae moves to showing several market and telco survey charts from IDC and Analysys Mason, what he calls 'The unvarnished truth'.

The first slide shows how the European enterprise communication service market is set to grow at a compound annual growth rate (CAGR) of 3% between 2020 and 2025.

"Three per cent growth, who thinks that is a great business for telcos?" says McRae. "And enterprise is what we are all depending on for big growth and change because [the] consumer [market] is pretty much flat," says McRae.

Another chart shows similar minimal growth: a forecast that Western Europe's mobile retail service market will grow from $102 billion in 2016 to $109 billion by 2026. Yet mobile is where the telcos spend a ton of money, he says.

"So, who thinks we should continue doing what we are doing?" McRae asks the audience.

Another forecast showing global fixed and mobile service revenues is marginally better since it includes developing nations that still lack telecommunications services.

In the UK, 95 per cent of the population is on the internet, in Europe it is 84%, says McRae: "The UK is a tough place to be to grow business."

Telco transformation

Another slide (see above), the results of a telco survey, shows a list of topics and their impact on telco transformation. McRae asks the audience to respond to those they think will 'save' the industry.

He goes through the list: cloud and cloudification, artificial intelligence (AI) and machine learning, 5G, and data analytics. The audience remains muted.

The next item is application programming interfaces (APIs). Again the audience is quiet. "You have been talking about APIs for two days!" says McRae.

"The right APIs," shouts an audience member. "Ah, yes, the right APIs," says McRae.

McRae continues down the list, virtualisation and software-defined infrastructure, OpenRAN elements - "not sure what the elements mean" - orchestration platforms, advanced process automation (OSS/BSS), micro-services, and blockchain.

McRae says he has spent the equivalent of a small nation's budget over his career on OSS and BSS. "Nothing is automated, and I can't get the data I need," he says.

McRae gives his view. He believes the cloud will help telcos, but what most excites him is AI and machine learning, and data analytics.

"Learning the insights the data tells us and using them, putting a pound sign on them," says McRae. "We have done some of that, but there is much more to do."

He puts up a second survey showing the priorities of European operators: customer experience and increasing operational agility.

"Finally, after years, telcos realise that customers are important," he says.

Opportunities

The survey also highlights the telcos' belief that they can deliver solutions for industries and enterprise customers.

"This is a massive opportunity for telcos that allows us to grow revenues, create cool technology and hire amazing engineers," says McRae.

The transformation needed in telecoms is about customers and taking risks with customers, he says.

One opportunity is digitalisation. McRae points outs that digitalisation is a process that never stops.

The three leading Chinese operators are keenly pursuing what they call industrial digitalisation or industrial internet. For China Telecom, industrial digitalisation now accounts for a quarter of its service revenues.

"Today, it is about cloud, cloud technologies, and smartphones, but tomorrow it could be about wearables or technology that is tracking what you are doing and making your life easier," says McRae.

Digitalisation is an expertise that the telecom industry is not putting enough effort into, he says: "And as telcos, we have a massive right to play here."

Another opportunity is AI and data, learning from the insights present in data to grow revenue.

"We have more data than most organisations, we haven't used it very well, and we can build upon it," says McRae, adding that AI needs the network to be valuable and improve our lives.

With data and AI, trust is vital. "If we are not trusted as an industry, we are dead," says McRae. But because telcos are trusted entities, they can help other organisations improve trustworthiness.

Another opportunity is using the network for humans to interact in advanced ways. Since telecoms is a resource-heavy industry, such network-aided interaction would be immediately beneficial.

For this, what is needed is a cloud-native platform that integrates well with the network, and cloud platforms are generally poorly integrated with the network, he says.

He ends his talk by returning to customers and what they want: customers expect networks and services to be always present.

This explains the telcos’ continual marginal growth, he says: "The reason we have this is because there is a big chunk of customers' lives where they can't rely upon the network."

Different thinking is needed if the network is to grow beyond the smartphone. Population coverage is not enough; what is needed is total coverage.

"Wherever I am, I want to use my device, to be connected, for the things that I don't even know is doing stuff to be able to do them without worrying about connectivity,” he says.

And that is why 6G must be about 100 per cent connectivity,” says McRae: "Either we can do it, or someone else is going to.”

With that, FutureNet comes to ends, and McRae quickly departs to embark on the next chapter in his career. `

Neil McRae will be one of the speakers at the DSP Leaders World Forum, May 23-24, 2023.