Imagine how useful 3D video calls would have been this last year.

The technologies needed - a light field display and digital compression techniques to send the vast data generated across a network - do exist but practical holographic systems for communication remain years off.

Source: Accelerating Innovation in the Telecommunications Arena

Source: Accelerating Innovation in the Telecommunications Arena

But this is just the sort of application that telcos should be pursuing to benefit their businesses.

A call for innovation

“Innovation in our industry has always been problematic,” says Don Clarke, formerly of BT and CableLabs and co-author of a recent position paper outlining why telecoms needs to be more innovative.

Entitled Accelerating Innovation in the Telecommunications Arena, the paper’s co-authors include representatives from communications service providers (CSPs), Telefonica and Deutsche Telekom.

In an era of accelerating and disruptive change, CSPs are proving to be an impediment, argues the paper.

The CSPs’ networking infrastructure has its own inertia; the networks are complex, vast in scale and costly. The operators also require a solid business case before undertaking expensive network upgrades.

Such inertia is costly, not only for the CSPs but for the many industries that depend on connectivity.

But if the telecom operators are to boost innovation, practices must change. This is what the position paper looks to tackle.

NFV White Paper

Clarke was one of the authors of the original Network Functions Virtualisation (NFV) White Paper, published by ETSI in 2012.

The paper set out a blueprint as to how the telecom industry could adopt IT practices and move away from specialist telecom platforms running custom software. Such proprietary platforms made the CSPs beholden to systems vendors when it came to service upgrades.

Don Clarke

The NFV paper also highlighted a need to attract new innovative players to telecoms.

“I see that paper as a catalyst,” says Clarke. “The ripple effect it has had has been enormous; everywhere you look, you see its influence.”

Clarke cites how the Linux Foundation has re-engineered its open-source activities around networking while Amazon Web Services now offers a cloud-native 5G core. Certain application programming interfaces (APIs) cited by Amazon as part of its 5G core originated in the NFV paper, says Clarke.

Software-based networking would have happened without the ETSI NFV white paper, stresses Clarke, but its backing by leading CSPs spurred the industry.

However, building a software-based network is hard, as the subsequent experiences of the CSPs have shown.

“You need to be a master of cloud technology, and telcos are not,” says Clarke. “But guess what? Riding to the rescue are the cloud operators; they are going to do what the telcos set out to do.”

For example, as well as hosting a 5G core, AWS is active at the network edge including its Internet of Things (IoT) Greengrass service. Microsoft, having acquired telecom vendors Metaswitch and Affirmed Networks, has launched ‘Azure for Operators’ to offer 5G, cloud and edge services. Meanwhile, Google has signed agreements with several leading CSPs to advance 5G mobile edge computing services.

“They [the hyperscalers] are creating the infrastructure within a cloud environment that will be carrier-grade and cloud-native, and they are competitive,” says Clarke.

The new ecosystem

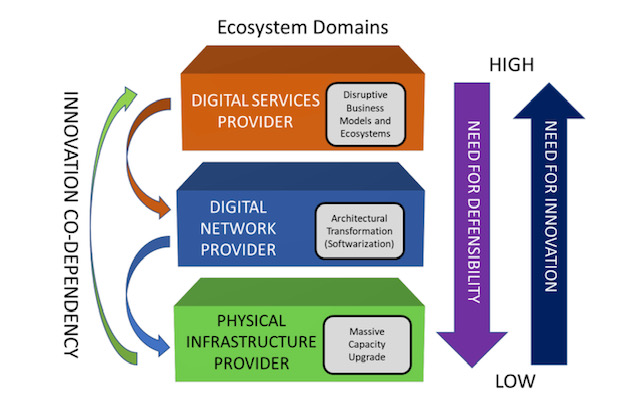

The position paper describes the telecommunications ecosystem in three layers (see diagram).

The CSPs are examples of the physical infrastructure providers (bottom layer) that have fixed and wireless infrastructure providing connectivity. The physical infrastructure layer is where the telcos have their value - their ‘centre of gravity’ - and this won’t change, says Clarke.

The infrastructure layer also includes the access network which is the CSPs’ crown jewels.

“The telcos will always defend and upgrade that asset,” says Clarke, adding that the CSPs have never cut access R&D budgets. Access is the part of the network that accounts for the bulk of their spending. “Innovation in access is happening all the time but it is never fast enough.”

The middle, digital network layer is where the nodes responsible for switching and routing reside, as do the NFV and software-defined networking (SDN) functions. It is here where innovation is needed most.

Clarke points out that the middle and upper layers are blurring; they are shown separately in the diagram for historical reasons since the CSPs own the big switching centres and the fibre that connect them.

But the hyperscalers - with their data centres, fibre backbones, and NFV and SDN expertise - play in the middle layer too even if they are predominantly known as digital service providers, the uppermost layer.

The position paper’s goal is to address how CSPs can better address the upper two network layers while also attracting smaller players and start-ups to fuel innovation across all three.

Paper proposal

The paper identifies several key issues that curtail innovation in telecoms.

One is the difficulty for start-ups and small companies to play a role in telecoms and build a business.

Just how difficult it can be is highlighted by the closure of SDN-controller specialist, Lumina Networks, which was already engaged with two leading CSPs.

In a Telecom TV panel discussion about innovation in telecoms, that accompanied the paper’s publication, Andrew Coward, the then CEO of Lumina Networks, pointed out how start-ups require not just financial backing but assistance from the CSPs due to their limited resources compared to the established systems vendors.

It is hard for a start-up to respond to an operator’s request-for-proposals that can be thousands of pages long. And when they do, will the CSPs' procurement departments consider them due to their size?

Coward argues that a portion of the CSP’ capital expenditure should be committed to start-ups. That, in turn, would instill greater venture capital confidence in telecoms.

The CSPs also have ‘organisational inertia’ in contrast to the hyperscalers, says Clarke.

“Big companies tend towards monocultures and that works very well if you are not doing anything from one year to the next,” he says.

The hyperscalers’ edge is their intellectual capital and they work continually to produce new capabilities. “They consume innovative brains far faster and with more reward than telcos do, and have the inverse mindset of the telcos,” says Clarke.

The goals of the innovation initiative are to get CSPs and the hyperscalers - the key digital service providers - to work more closely.

“The digital service providers need to articulate the importance of telecoms to their future business model instead of working around it,” says Clarke.

Clarke hopes the digital service providers will step up and help the telecom industry be more dynamic given the future of their businesses depend on the infrastructure improving.

In turn, the CSPs need to stand up and articulate their value. This will attract investors and encourage start-ups to become engaged. It will also force the telcos to be more innovative and overcome some of the procurement barriers, he says.

Ultimately, new types of collaboration need to emerge that will address the issue of innovation.

Next steps

Work has advanced since the paper was published in June and additional players have joined the initiative, to be detailed soon.

“This is the beginning of what we hope will be a much more interesting dialogue, because of the diversity of players we have in the room,” says Clarke. “It is time to wake up, not only because of the need for innovation in our industry but because we are an innovation retardant everywhere else.”

Further information:

Telecom TV's panel discussion: Part 2, click here

Tom Nolle's response to the Accelerating Innovation in the Telecommunications Arena paper, click here