What is being announced?

ECI Telecom has detailed its wireless backhaul offering that spans the cell tower to the metro network. The 1Net wireless backhaul architecture supports traditional Sonet/SDH to full packet transport, with hybrid options in between, across various physical media.

“We can support any migration scheme an operator may have over any type of technology and physical medium, be it copper, fibre or microwave,” says Gil Epshtein, senior product marketing manager, network solutions division at ECI Telecom.

Why is this important?

Operators are experiencing unprecedented growth in wireless data due to the rise of smart phones and notebooks with 3G dongles for mobile broadband.

Mobile data surpassed voice traffic for the first time in December 2009, according to Ericsson, with the crossover occurring at approximately 140,000 terabytes per month in both voice and data traffic. According to Infonetics Research, mobile broadband subscribers surpassed digital subscriber line (DSL) subscribers in 2009, and will grow to 1.5 billion worldwide in 2014. By then, there will be 3.6 exabytes (3.6 billion gigabytes) per month of mobile data traffic, with two thirds being wireless video, forecasts Cisco Systems.

“The challenge is that almost all the growth is packet internet traffic, and that is not well suited to sit on the classic TDM backhaul network originally designed for voice,” says Michael Howard, principal analyst, carrier and data center networks at Infonetics Research. TDM refers to time division multiplexing based on Sonet/SDH where for wireless backhaul T1/E1lines are used.

“There is a gap between the technology hype and real life”

Gil Epshtein, ECI Telecom

The fast growth also implies an issue of scale, with the larger mobile operators having many cell sites to backhaul. E1/TI lines are also expensive even if prices are coming down, says Howard: “It is much cheaper to use Ethernet as a transport – the cost per bit is enormously better.”

This is why operators are keen to upgrade their wireless backhaul networks from Sonet/SDH to packet-based Ethernet transport. “But there is a gap between the technology hype and real life,” says Epshtein. Operators have already invested heavily in existing backhaul infrastructure and upgrading to packet will be costly. The operators also know that projected revenues from data services will not keep pace with traffic growth.

“Operators are faced with how to build out their backhaul infrastructures to meet service demands at cost points that provide an adequate return on investment,” says Glen Hunt, principal analyst, carrier transport and routing at Current Analysis. Such costs are multi-faceted, he says, on the capital side and the operational side. “Carriers do not want to buy an inexpensive device that adds complexity to network operations which then offsets any capital savings.”

“It is much cheaper to use Ethernet as a transport –the cost per bit is enormously better.”

Michael Howard, Infonetics Research

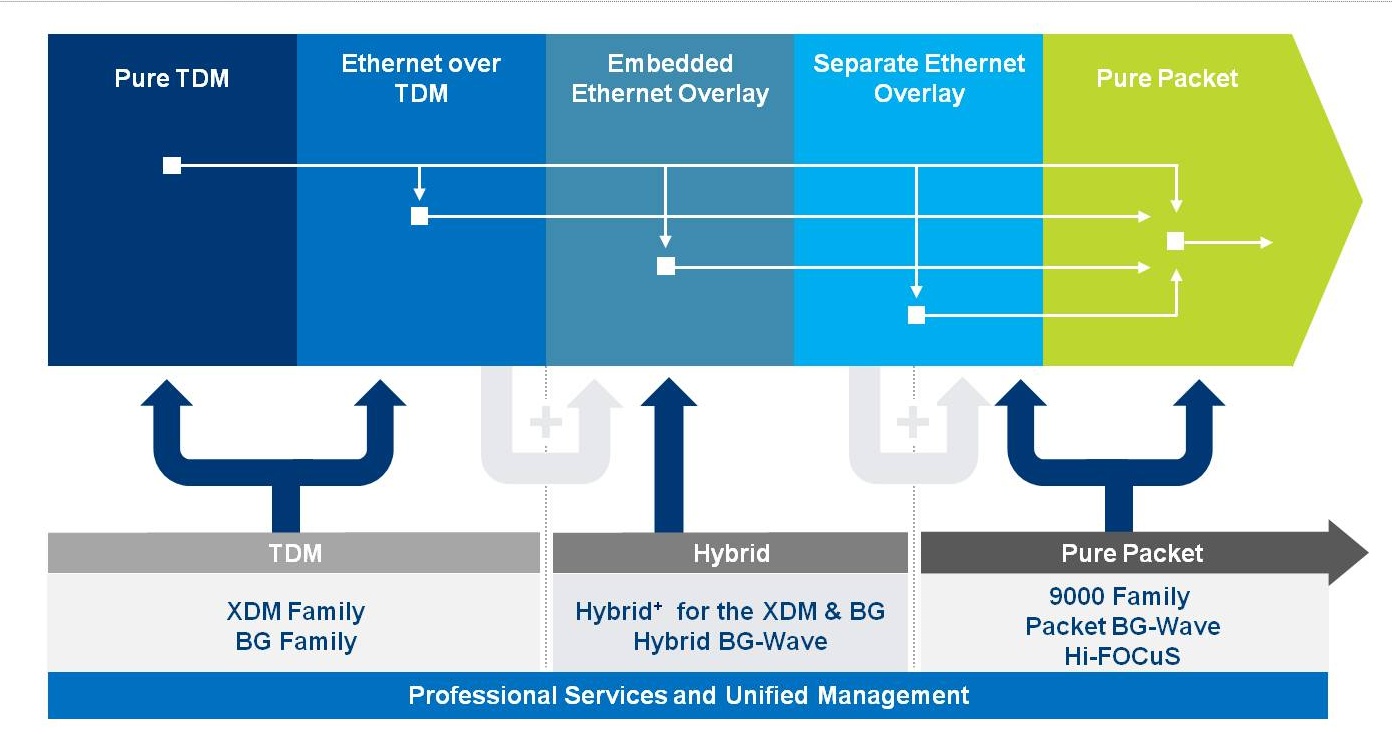

To this aim, ECI offers operators a choice of migration schemes to packet-based backhaul. Its solution supports T1/E1lines and Ethernet frame encapsulation over TDM, Ethernet overlay networks, and packet-only networks (see chart above).

With Ethernet overlay, an Ethernet network runs alongside the TDM network. The two can co-exist within a common network element, what ECI calls embedded Ethernet overlay, or separately using distinct TDM and packet switch platforms. And when an operator adopts all-packet, legacy TDM traffic can be carried over packets using circuit emulation pseudo-wire technology.

“ECI’s offering is significant since it includes all the components and systems necessary to handle nearly any type of backhaul requirement,” says Hunt. The same is true for most of the larger system vendors, he says. However, many vendors integrate third party devices to complete their solutions – ECI itself has done this with microwave. But with 1NET for wireless backhaul, ECI will now offer its own microwave backhaul systems.

According to Infonetics, between 55% and 60% of all backhaul links are microwave outside of North America. And 80% of all microwave sales are for mobile backhaul. Moreover, Infonetics estimates that 70 to 80% of operator spending on mobile backhaul through 2012 will be on microwave. “Those are the figures that explain why ECI has decided to go it alone,” says Howard. Until now ECI has used products from its microwave specialist partner, Ceragon Networks.

“ECI has all the essential features that the other big players have like Ericsson, Alcatel-Lucent, Nokia Siemens Networks and Huawei,” says Howard. What is different is that ECI does not supply radio access network (RAN) equipment such as basestations. “It is ok, though, because almost all of the [operator] backhaul tenders separate between RAN and backhaul,” says Howard.

ECI argues that by adopting a technology-agnostic approach, it can address operators’ requirements without forcing them down a particular path. “Operators are looking for guidance as to which path is best from this transition,” says Epshtein. There is no one-model fits all. “We have so many exceptions you really need to look on a case-by-case basis.”

In developed markets, for example, the building of packet overlay is generally happening faster. Some operators with fixed line networks have already moved to packet and that, in theory, simplifies upgrading the backhaul to packet. But organisational issues across an operator’s business units can complicate and delay matters, he says.

And Epshtein cites one European operator that will use its existing network to accommodate growth in data services over the coming years: “It is putting aside the technology hype and looking at the bottom line."

In emerging markets, moving to packet is happening more slowly as mobile users’ income is limited. But on closer inspection this too varies. In Africa, certain operators are moving straight to all-IP, says Ephstein, whereas others are taking a gradual approach.

What’s been done?

ECI has launched new products as well as upgraded existing ones as part of its 1NET wireless backhaul offering.

The company has announced its BG-Wave microwave systems. There are two offerings: an all-packet microwave system and a hybrid one that supports both TDM and Ethernet traffic. ECI says that having its own microwave products will allow it to gain a foothold with operators it has not had design wins before.

“ECI will need to prove the value of its microwave products with actual field deployments”

Glen Hunt, Current Analysis

ECI has announced two additional 9000 carrier Ethernet switch routers (CESR) families: the 9300 and 9600. These have switching capacities and a product size more suited to backhaul. The switches support Layer 3 IP-MPLS and Layer 2 MPLS-TP, as well as the SyncE and IEEE 1588 Version 2 synchronisation protocols.

ECI has also upgraded its XDM multi-service provisioning platform (MSPP) to enable an embedded overlay with Ethernet and TDM traffic supported within the platform.

“When an operator is choosing to add packet backhaul to existing TDM backhaul, typically it is a separate network – they keep voice on TDM and add a second network for packet,” says Howard. This hybrid approach involves adding another set of equipment. “ECI has added functions to existing equipment, which operators may already have, that allows two networks to run over a single set of products.”

Also included in the solution are ECI’s BroadGate and its Hi-FOCuS multi-service access node (MSAN). This is not for operators to deploy the platform for wireless backhaul but rather those operators that have the MSAN can now use it for backhauling traffic, says Ephstein. This is useful in dense urban areas and for operators offering wholesale services to other operators.

All the network elements are controlled using ECI’s LightSoft management system.

“ECI’s solution has the advantage that all the systems use the same operating system and support the same features,” says Hunt. He cites the example of MPLS-TP which is implemented on ECI’s carrier Ethernet and optical platforms.

“ECI has a full range of platforms that all work together to meet the needs of mobile as well as fixed operator,” says Hunt. “ECI will need to prove the value of its microwave products with actual field deployments.”

Operator interest

ECI has secured general telecom wins with large incumbent operators in Western Europe and has been winning business in Eastern Europe, Russia, India and parts of Asia.

ECI’s sweet spot has been its relationship with Tier 2 and Tier 3 operators, says Hunt, and since the company offers broadband access, optical transport, and carrier Ethernet, it can use these successes to help expand into areas such as wireless backhaul.

But wireless backhaul is already a key part of the company’s business, accounting for over 30% of revenues, says Ephstein. Late last year ECI estimated that it was carrying between 30% and 40% of the mobile backbone traffic in India, a rapidly growing market.

As for 1NET wireless backhaul, ECI has announced one win so far - Israeli mobile operator Cellcom which has selected the 9000 CESR family. “Cellcom shows that ECI can continue to expand its presence in the network - in this case leveraging business Ethernet services to add backhaul,” says Hunt.

In addition one European operator, as yet unnamed, has selected ECI’s embedded overlay. “Several other operators are in various stages of selecting the right option for them,” says Ephstein.

- For some ECI wireless backhaul papers and case studies, click here